If you wish to help ConservativeHQ reach more readers then donate here.

If you pay any attention at all to economic news you know about the astonishing rise in gold prices over the past year – up 60% even as inflation has moderated. This rise in the price of gold has been accompanied by another troubling trend – the fall of the U.S. dollar.

Our friend Stephen Moore’s Committee to Unleash Prosperity Hotline newsletter suggests the Visual Capitalist website may offer some insight into these two mysterious and troubling trends.

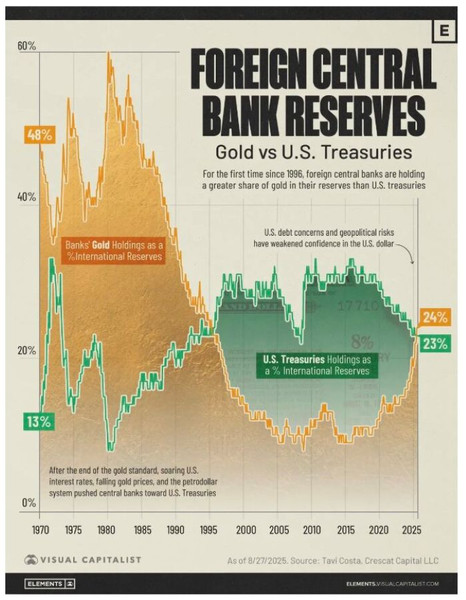

The Visual Capitalist chart shows that since around 2020, foreign central banks (mostly the Chinese) have been selling U.S. government bonds and transferring that money into purchases of gold.

For the first time since 1995, these central banks hold more gold than U.S. Treasuries, observed Steve.

According to the Visual Capitalist, Central banks bought 1,136 tons of gold in 2022 — the most on record — with 2023 and 2024 maintaining strong accumulation.

Central banks now hold 36,000 tons of gold, according to a European Central Bank study, having hoovered up huge volumes since the post-pandemic inflation spike and Russia's invasion of Ukraine in 2022. They have increased their holdings by more than 1,000 metric tons in each of the last three years, a record pace and double the average annual purchases in the preceding decade reported Reuters columnist Jamie McGeever.

Mr. McGeever further reported gold has recently surpassed the euro to become the second-largest global reserve asset after the U.S. dollar and suggested this is part of a global diversification strategy driven by worries over inflation, deteriorating U.S. fiscal health, Federal Reserve independence, and geopolitical instability that raised questions about the stability of long-term Treasuries.

We have a different take.

While Mr. McGeever and most analysts seem to see the selloff of Treasuries as part of an apolitical risk management strategy, we tend to see it as part of the ongoing economic war against the United States being conducted by Red China and Russia through the creation of BRICS, and other means.

Larry Kudlow has said he suspects this is an aggressive and orchestrated attack on the dollar by President Xi in Beijing – an attack we note that was initiated during the Biden administration’s weakness and no doubt ignored in large measure because of the $30 million Red Chinese investment in the Bidens.

Zineb Riboua, writing for the Hudson Institute reminded us that in July, President Donald Trump told his cabinet, “BRICS was set up to hurt us, BRICS was set up to degenerate our dollar and take our dollar . . . off as the standard.”

BRICS—once a loose grouping of developing markets that included Brazil, Russia, India, China, and South Africa—has in recent years expanded aggressively to challenge Western-led institutions and erode US financial primacy.

In the early 2000s, Red China began presenting itself as the champion of the developing world, expanding ties with Africa, Asia, and Latin America, and emphasizing multipolarity as an alternative to Western financial dominance.

The creation of the BRICS New Development Bank in 2014, the spread of bilateral currency swap agreements, and the gradual promotion of yuan-denominated trade are all instruments designed to erode dollar centrality while presenting the project as reformist rather than revolutionary.

Russia also embraced BRICS as a framework of resistance to American and Western economic domination with the Axis of Russia, Communist China and Iran fitting neatly into Vladimir Putin’s idea of a new Eurasian-centered new world order as visualized by Alexander Dugin and his concept of a political and economic system based on Eurasian National Bolshevism.

Steve Moore said in the Hotline that Larry Kudlow (and we) may be right, but China may be crazy. “Beijing’s futile attempt to replace the dollar as the world reserve currency will fail miserably. In times of global crisis and turmoil, investors buy MORE, not fewer, dollars as a flight to safety. Anyone who would rush off to invest in BRICS (Brazil, Russia, India, and China) as a more stable alternative is likely to suffer large losses over time.”

Over time, Steve may be right, but Red China has declared all domain war on the United States and we think it prudent to approach this Chinese-led flight from Treasuries to gold as a new front in the economic domain of that war.

George Rasley is editor of Richard Viguerie's ConservativeHQ.com and is a veteran of over 300 political campaigns. A member of American MENSA, he served on the staff of Vice President Dan Quayle, as spokesman for retired Rep. Mac Thornberry, formerly a member of the House Intelligence Committee and Chairman of the House Armed Services Committee, and as Director of Communications for now-retired Rep. Jeb Hensarling, formerly Chairman of the House Financial Services Committee.

- China Matrix

- Chinese farmland purchases

- The Unrestricted War movie

- Donald Trump administration

- ban Chinese land purchases

- Wall Street

- China trade

- Jamie Dimon

- Brian Moynihan

- Kamala Harris donors

- Office of Professional Responsibility (OPR)

- Contemporary Amperex Technology Co.

- CATL

- FrankenAI

- Artificial Intelligence

- Obamagate

- Representative John Moolenaar (R-MI)

- Chairman of the House Select Committee on China

- BRICS

Wanna help us reach more readers?

Since 1999, ConservativeHQ has been providing for free news and information for conservative leaders and activists intended to help grow the conservative movement so large that conservatives will govern America.

If you enjoy our content and wish to help finance the success and growth of ConservativeHQ, then I urge you to donate here, or mail a contribution to: ConservativeHQ, 9625 Surveyor Court, Ste 400, Manassas, VA 20110. Your contribution is not tax deductible, but greatly appreciated!